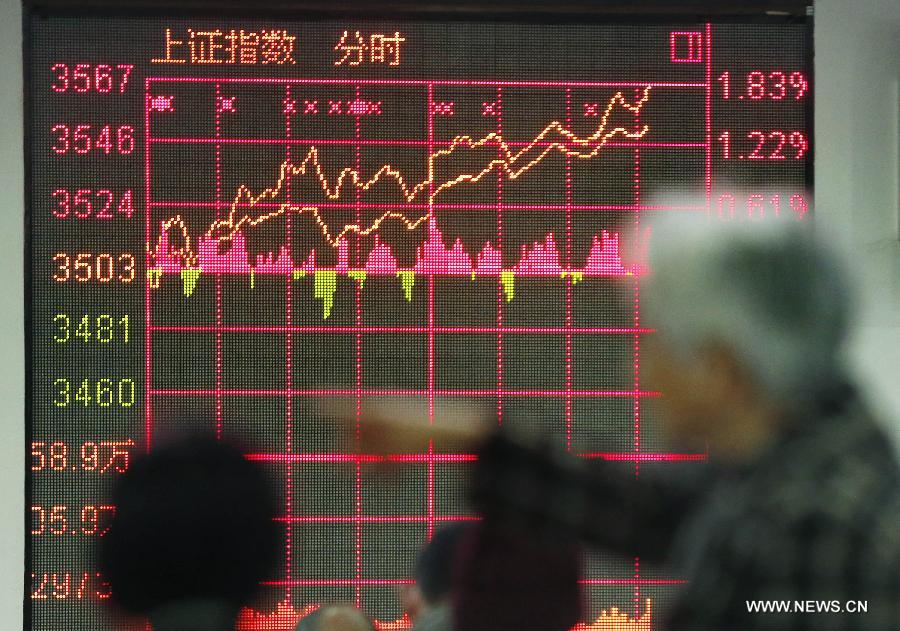

Investors look through stock information at a trading hall of a securities firm in Shanghai, east China, March 18, 2015. Chinese shares consolidated near seven-year highs on Wednesday, with the benchmark Shanghai Composite Index up 2.13 percent to finish at 3,577.30 points. The Shenzhen Component Index went up 2.68 percent to close at 12,496.24 points. (Xinhua/Ding Ting)

BEIJING -- Chinese shares consolidated near a seven-year high on Wednesday, with the benchmark Shanghai Composite Index up 2.13 percent to finish at 3,577.30 points.

The Shenzhen Component Index went up 2.68 percent to close at 12,496.24 points.

Combined turnover on the two bourses amounted to 1.12 trillion yuan (182 billion U.S. dollars), flat from the previous session.

Nearly 100 stocks on the two markets jumped by the daily limit of 10 percent, with big gainers including bank, railway and steel shares.

Market sentiment is strong as the central bank has injected 500 billion yuan into commercial banks via medium-term lending facility (MLF), raising expectations of further cuts in interest rates or the reserve requirement ratio for banks, said Chen Wei, an analyst with CITIC Securities.

The liquidity injection boosted bank shares. China Everbright Bank soared 9.5 percent and Agricultural Bank of China moved up 3.53 percent.

High speed rail manufacturer China CNR rose 10 percent after it announced that it will bid for a high-speed railway project in Russia next month. China CSR also jumped 10 percent in response to its merger with China CNR.

Steel shares were strong, with the sub-index tracking the sector rising 3.26 percent. Hunan Valin Steel and Xinjiang Bayi Iron and Steel jumped 10 percent.

The ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, gained 2.13 percent to end at a new high of 2,182.92 points.

Two indices that track the performance of the country's New Three Board, a national equity exchange platform for non-listed medium and small-sized companies, were launched on Wednesday.

The Component Index for the New Three Board rose 5.71 percent, and the Market Maker Index for the New Three Board rose 1.73 percent.

The New Three Board, which started trading on January 2013, has attracted 2,113 companies with market value of 790 billion yuan.