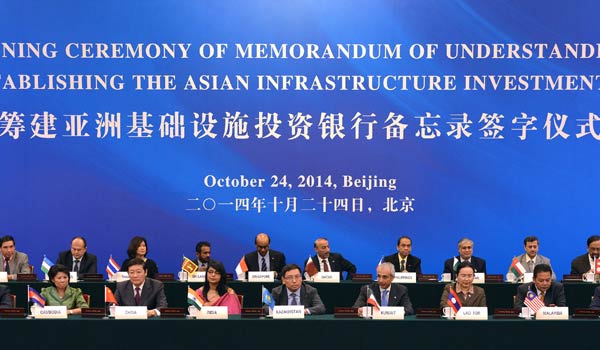

The signing ceremony of memorandum of understanding on establishing the Asian Infrastructure Investment Bank (AIIB) is held in Beijing, Oct 24 2014. [Photo/Xinhua]

Chief negotiators will meet in Singapore on Wednesday on behalf of founding members to vie for the top five positions at China-backed Asian Infrastructure Investment Bank (AIIB).

Media reports show that the AIIB plans to distribute 75 percent of its shares to Asian nations. And stakes will be divided among the member countries based on their gross domestic product and purchasing power parity.

If so, as Korea Institute for International Economic Policy estimated in a report, China will take the most shares, followed by India, Indonesia, Germany and South Korea.

But this is still up for discussion, as nothing has been confirmed yet.

The gathering, called the 5th chief negotiators' meeting, will also discuss the draft articles of agreement and the bank's operational policies for the AIIB, a Singapore Ministry of Finance statement said on Tuesday.

The three-day meeting will be co-chaired by Shi Yaobin, vice minister of China's Ministry of Finance, and Yee Ping Yi, deputy secretary of Singapore's Ministry of Finance, said the statement.

A total of 57 countries have joined AIIB as its founding members. But the United States, Japan and Canada remain absentees among the Group of Seven (G7) industrialized countries.

Media reports have claimed that Japan is poised to announce $100 billion investment in roads, bridges, railways and other building projects in Asia, weeks after China outlined its vision for a new infrastructure development bank in the region.

The sum is in line with the expected $100 billion capital base of the AIIB that Beijing and more than 50 founding member states are establishing.

Washington had cautioned nations about joining the bank, seen as a rival to the US-dominated World Bank, citing what it called a lack of transparency, doubts about lending and environmental safeguards, and concerns over Beijing's influence.

Beijing says it will not hold veto power inside the AIIB, unlike the World Bank where Washington has a limited veto.

Founder members will initially pay up to one-fifth of the AIIB'S $50 billion authorized capital, which will eventually be raised to $100 billion.

Reuters contributed to this story.